©Worawee Meepian/ISTOCK/THINKSTOCK

Changes in senior management, shifting corporate strategies, material acquisitions, restructuring activities, and other major corporate events can trigger significant changes in a company’s operations. Furthermore, such events may often necessitate that a company change its reporting composition.

Understanding the accounting implications and valuation requirements associated with a change in reporting structure and thus, a goodwill reassignment, is important for proper planning and the avoidance of potential missteps during the process. In this article, we describe the prevalence and common triggering events behind goodwill reassignments across the broader U.S. market and discuss relevant accounting guidance.

Goodwill Reassignment

When an entity that follows U.S. generally accepted accounting principles (GAAP) reorganizes its reporting structure and changes the composition of one or more reporting units, goodwill is reassigned to the reporting units affected using a relative fair value allocation approach. Specifically, this approach is similar to that used when a portion of a reporting unit is to be disposed of pursuant to Financial Accounting Standards Board Accounting Standards Codification (ASC) 350-20-40-1 through 40-7.

Prevalence of Goodwill Reassignments

We reviewed annual reports of U.S. companies filed with the Securities and Exchange Commission (SEC) for fiscal year periods ending January 1, 2012 through December 31, 2017. Specifically, we screened for companies that matched all of the following criteria:

- SEC registrant was domiciled in the United States

- The company maintained goodwill on its balance sheet at some point during the 2012 to 2017 time period

- One of the following phrases was included within an annual report filed with the SEC during the applicable time window:

- Goodwill reallocation

- Goodwill realignment

- Goodwill reassignment

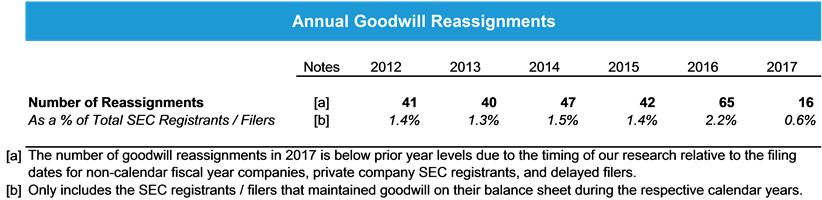

Based on the screening process above, we identified more than 250 instances of a goodwill reassignment within the data set of U.S. companies. Furthermore, the data suggests that the frequency of goodwill reassignments remained consistent over the six-year time window that we analyzed (Figure 1).

The most common cause of goodwill reassignments was a “change to organizational structure,” which most frequently resulted in an increase or decrease in the number of reporting units. Although the underlying reason for the organizational structure change was not always discussed in the SEC filings, common reasons include the following:

- Recent acquisitions or divestitures

- Changes in strategy or realignment of management teams

- Restructuring activities or facility closures

- Realignment of product lines between segments

- Reclassification of net sales or segment profit between segments

- Transfer of other assets (liabilities) between segments

Although the total number of companies performing a goodwill reassignment typically ranged between 1 and 2 percent of total U.S.-based SEC registrants that maintain goodwill, many companies will encounter one or more of the organizational changes referenced above at some point.

Accounting Guidance

The accounting rules for goodwill reassignments focus on a relative fair value allocation approach. There is no explicit definition of this term within the ASC literature, but the guidance includes the following simplified example within ASC 350-20-40-3:

- Business is being sold for $100

- The fair value of the reporting unit excluding the business being sold is $300

- 25 percent of the goodwill residing in the reporting unit would be included in the carrying amount of the business to be sold

- The 25 percent amount is calculated as $100 divided by [$100 + $300]

This process requires a fair value assessment of the reporting units that are affected by a change in the company’s reporting structure. Traditional valuation methods include an Income Approach, Market Approach, and Cost Approach. For going concern businesses that are expected to generate positive future cash flows, the most common valuation methodologies employed are the discounted cash flow method (a form of the Income Approach), the guideline public company method (a form of the Market Approach), and the merger and acquisition method (also a form of the Market Approach). These three methods were also the most common valuation approaches cited within the SEC filing data for the registrants’ goodwill reassignments.

While we focus on the reassignment of goodwill, the guidance in ASC 350-20-35-39 through 35-40 is also used to reassign other assets and liabilities to the reporting units affected by a change in a company’s reporting structure. According to ASC 350-35-40, the methodology used to determine the amount of the assets and liabilities to assign to a reporting unit shall be “reasonable and supportable and shall be applied in a consistent manner.” This may range from a high-level allocation based on revenue, expenses, or employees to a more sophisticated fair value-based assessment.

One other point that is worth noting is related to the guidance in ASC 350-20-35-3C, which provides various examples of events and circumstances that could be deemed a “triggering event” which requires a company to perform an interim goodwill impairment assessment. In particular, “events affecting a reporting unit such as a change in the composition or carrying amount of its net assets” and “a more-likely-than-not expectation of selling or disposing of all, or a portion, of a reporting unit” are referenced. In our experience, a company reorganization that results in a reporting structure change such that goodwill shall be reassigned is deemed a “triggering event” that requires an interim goodwill impairment assessment. Therefore, the fair value of the legacy reporting unit(s) must first be determined as of the goodwill reassignment date to assess whether there is an indication of impairment before the reassignment. After that determination is made, the assets and liabilities of the legacy reporting unit(s), including the incorporation of goodwill impairment (if any) from the interim test, is allocated to the new reporting unit structure.

Read the full article including a case study here.

This article is intended for general information purposes only and is not intended to provide, and should not be used in lieu of, financial, accounting, legal, or other professional advice. The publisher assumes no liability for readers’ use of the information herein, and readers are encouraged to seek professional assistance with regard to specific matters. All opinions expressed in this article are those of the authors and do not necessarily reflect the views of Stout Risius Ross, LLC, Stout Advisors SA, Stout Bluepeak Asia Ltd., or Stout Risius Ross Advisors, LLC.