Thanks to narrow victories in major swing states, Joe Biden will become the next President of the United States, but this won’t mean the end of uncertainty for the U.S. economy. After all, Donald Trump has filed lawsuits alleging election fraud and a judiciary battle is brewing that could last until early December.

After Biden is sworn in, he won’t have as much leeway without a clear Congressional majority, even if executive orders, his long experience in negotiating bipartisan agreements and Republican fatigue with partisanship could play a positive role. There are still changes to watch for under a Biden administration, especially for companies and business leaders. Besides healing the wounds of Covid-19 with a much-needed stimulus package and rebuilding internal cooperation, Biden’s platform has put reducing inequalities and redistributing wealth front and center, and the unwinding of Trump’s tax cuts will be at the top of the agenda.

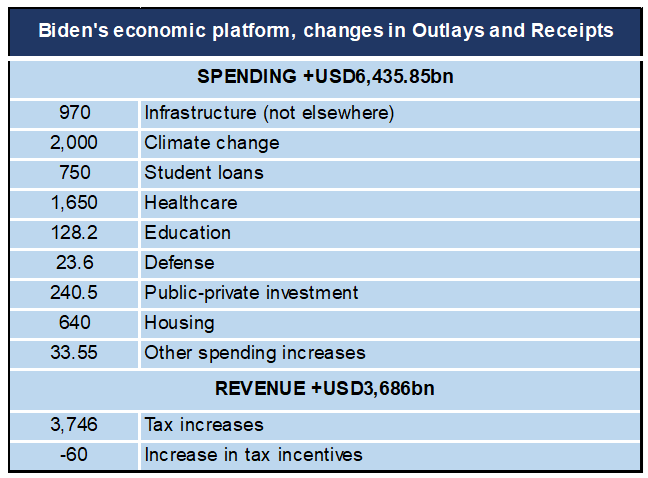

Figure 1: Biden’s economic platform

Sources: Euler Hermes, Allianz Research

A major shake-up in taxes

In 2017, Trump’s Tax Cuts and Jobs Act eliminated corporate income tax brackets, leading the corporate tax rate to drop to 21%. It also cut by half the minimum tax on global income originating from intangible assets, such as patents, trademarks and copyrights, repealed the corporate alternative minimum tax and rearranged the graduated personal income tax system, notably by decreasing the top individual tax rate to 37%.

Biden’s platform is very much the opposite. Part of his planned policies can be categorized as economic paternalism, or an effort to persuade businesses to act in ways more beneficial to the public and less towards maximizing profits. Biden’s Tax Plan would reverse much of Trump’s changes by:

- Increasing the corporate income tax rate to 28%

- Reversing Trump’s individual tax rate decrease on high incomes

- Re-introducing a 15% minimum book tax on corporations with income higher than $100 million

- Limiting itemized deductions

- Repealing Trump’s reform on the taxation of intangible assets

- Taxing capital gains at ordinary income tax rates instead of the current 23.8% rate for those earning over $1 million

- Subjecting incomes above $400,000 to the 12.4% Social Security payroll tax

With these changes, non-financial companies could see their profit margins fall to 5-6% as a percentage of GDP, compared to an average of 7.4% since 2010. This tax plan will certainly be one of the more difficult bills to pass in Congress, with fierce opposition from Republicans. This is why the increase in the official corporate tax rate could be partially offset by tax credits that may be offered in Biden’s plan to combat climate change, which could result in an effective tax rate close to 20%.

Rebalancing corporate and global competition

Biden has also promised to support stricter privacy safeguards and antitrust oversight on social media platforms such as Facebook, Twitter and Google, but he has not indicated that a breakup of the oligopoly is in the making. Given his former advocacy for credit card companies and banks, it’s unlikely that anti-trust actions would be aimed at the financial services industry, even if Democratic party could sway him towards more oversight and regulation as well as stricter implementation of the law.

Other key sectors will be specifically incentivized, including medical supplies and essential materials such as steel and cement, to revitalize manufacturing in conjunction with the $400 billion portion of the “Made in all America” initiative. R&D efforts that also fall under that program include $300 billion on 5G, artificial intelligence and biotechnology. Biden is also a staunch proponent of union jobs and supports traditional manufacturing such as automotive, where he hopes to create 1 million new jobs. Military spending is likely to be reduced and rebalanced, emphasizing new technologies such as AI and moving away from legacy systems. This will boost technology companies, dampening spending on more well-established and traditional defense contractors.

An iron fist in a velvet glove in terms of trade and external policy

In terms of protectionism, don’t expect Biden to undo what Trump began. Since the beginning of Trump’s mandate, average U.S. tariffs have increased from 3.5% to 7%, with a peak above 8%. That peak was reversed at the beginning of 2020, thanks to the Phase 1 U.S.-China trade deal, in which China committed to increase its imports from the U.S. by $200 billion over two years. China is running behind on this commitment, with only $58.8 billion out of the $140 billion initially planned having been purchased as of September. That means Biden will have some bargaining power to justify a slow back-pedaling in protectionist trade policy, especially as the Phase 1 deal has produced tangible results in terms of intellectual property rights and sanitary and phytosanitary standards, as well as access to financial markets.

However, unlike his predecessor, Biden will adopt a coordinated and less unilateral approach to China, in particular on technology and intellectual property. This multilateral approach, along with the adherence to more ambitious climate standards, is likely to revive non-tariff barriers via the implementation of new technical, phytosanitary or environment-friendly norms.

In the short-term, as the U.S. battles a second wave of Covid-19, it could see a -4.2% y/y GDP contraction in 2020, followed by a recovery of +3.6% y/y in 2021. But over the long term, the big “winner” of this election – although not in a good way – is public debt. The complete execution of Biden’s economic platform will see U.S. public debt rise to 159% of GDP in 2030, compared with 135% in 2020. And this will come with a cost for the U.S. economy’s growth potential: after about +2% today, potential growth in the U.S. could decline to +1.4% by 2030.

Alexis Garatti is the Global Head of Economic Research at Euler Hermes.