Few, if any, analysts have questioned financial executives about their lease plans during the Q&A sessions of recent earning calls, where a majority of the accounting discussions revolved around revenue recognition issues.

And even once implementation begins in earnest as the 2019 deadline grows nearer, equity analysts admit they see fewer ramifications on their buy/sell decisions and models.

"Revenue recognition affects all companies, while with leasing you may have some very specific industries and companies that are impacted significantly. From an equity analysis perspective we expect the lease accounting changes to be less complex,” says Zhen Deng, a senior analyst with CFR

According to new standards passed by the Financial Accounting Standards Board (ASC 842), public companies will be required to report operating leases on their balance sheets. The rule goes into place for public companies beginning in 2019.

Financial executives have expressed concern regarding the rules implementation, with only a little over 20 percent saying they felt “extremely” or “very” prepared to comply with the FASB rule, according

to a recent study by Deloitte. In addition, the new rule “may require major changes to systems and processes” to achieve compliance that will translate into a large resource commitment, the firm states in a separate report.

The accounting change will likely have the greatest impact on specific industries, such as chain restaurants, where operating leases are a significant portion of the business.

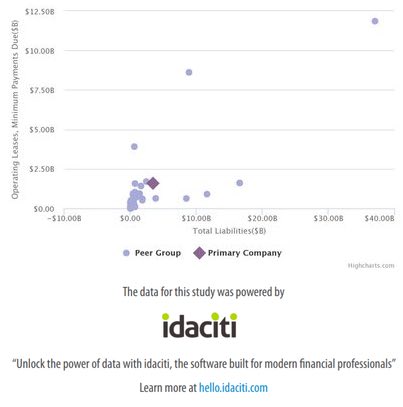

The new lease standard requires companies to report the operating leases on the balance sheet. This scatter plot shows the relative value of the present value of the minimum operating lease payments to total liabilities. McDonalds and Starbucks appear to be the two outlying companies to be severely impacted by the standard.

To interact with the chart from Idaciti, click on the image below.

Some financial leaders in those sectors offered insight into the plans for implementation, often unprompted and with little follow up from analysts.

“Today, the majority of our real estate leases are considered operating leases for accounting purposes,” said Tara M. Comonte, CFO of Shake Shack Inc. on a May 3 earnings call. “Assuming that they continue to be classified as such, our general understanding at this time is that in terms of P&L impact, we will incur operating lease payments over the term of the lease recorded within our occupancy cost line.”

But as preparers scramble to implement the changes, analysts that will create, buy and sell recommendations remain skeptical. In fact, some analysts have already said that they plan to ignore the new disclosures resulting from the lease accounting change in favor of their own calculations.

“After this accounting rule change goes into effect, we will continue to calculate operating lease liabilities and expenses as we always have. Given the likely variances in how companies will calculate their operating lease debt, we will remove what they report on the balance sheet and replace it with our calculated value,” analysts from research firm New Constructs said in an April research note. “Our values will provide far greater comparability for all companies with operating leases as well as for the year-over-year results of individual companies.”

At the end of the day, many equity analysts will feel more comfortable doing their own leasing math.

“There are people looking at the upcoming changes on leasing, but the main change is the grossed up balance sheet and possibly some non-GAAP metrics. Based on what I’m seeing most analysts that cover industries where there are significant operating leases already treat them as debt like,” CFRA’s Deng explains. “They currently estimate the off balance sheet amount of lease obligations using their own methods.”

Editor's note: This post was updated to clarifiy the quotes of Ms. Deng.