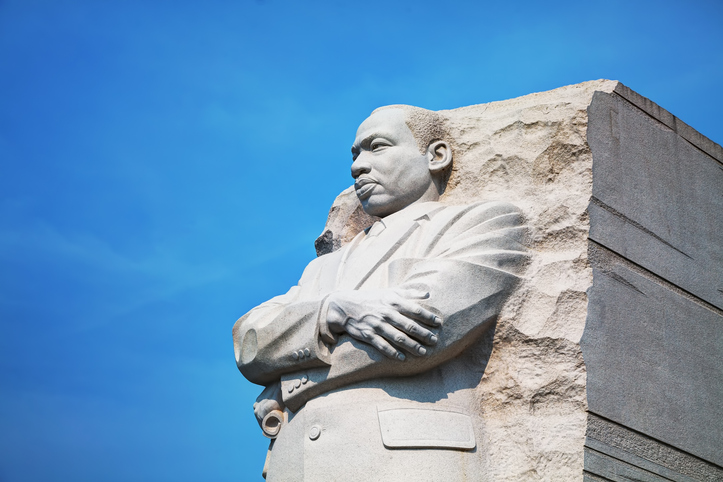

© AndreyKrav/iStock/Getty Images Plus

Boards that include more directors with diverse backgrounds and experiences are more effective on a variety of measures, including financial performance, risk oversight and sustainability.

FEI Daily spoke with KPMG BLC Senior Advisor Stephen Brown about the ways in which COVID-19 has disproportionately affected employees and communities of color and how companies can go beyond acknowledgement and statements.

FEI Daily: For those who aren’t aware, how has COVID-19 and the economic downturn disproportionately affected employees and communities of color?

Stephen Brown: There are several storms all Americans are weathering, but in different boats. As the Centers for Disease Control and Prevention and others have noted, there is ample evidence that some racial and ethnic minority groups are disproportionately affected by COVID-19. Biomedical factors, social determinants of health, and greater opportunity for exposure due to living and working conditions may portend worse COVID-19 and economic outcomes. Further, we are experiencing a renewed reckoning on racial justice and diversity. As a result, diversity and inclusion efforts inside of corporations, among other spaces, are coming under greater scrutiny in the U.S. Effectively addressing diversity and inclusion requires companies to have a clear understanding of why it matters to their long-term performance and what policies should be embedded as a business imperative.

Stephen Brown: There are several storms all Americans are weathering, but in different boats. As the Centers for Disease Control and Prevention and others have noted, there is ample evidence that some racial and ethnic minority groups are disproportionately affected by COVID-19. Biomedical factors, social determinants of health, and greater opportunity for exposure due to living and working conditions may portend worse COVID-19 and economic outcomes. Further, we are experiencing a renewed reckoning on racial justice and diversity. As a result, diversity and inclusion efforts inside of corporations, among other spaces, are coming under greater scrutiny in the U.S. Effectively addressing diversity and inclusion requires companies to have a clear understanding of why it matters to their long-term performance and what policies should be embedded as a business imperative.

FEI Daily: Employees, customers, investors and communities expect companies to help drive real, lasting change. How can companies go beyond acknowledgement and statements? What are some of the specific actions?

Brown: Actions must match words or acknowledgement statements will be viewed as simply perfunctory and unhelpful to driving change. Investors have clearly articulated their desire for more transparency about board diversity and how the board views and thinks about diversity. Until recently, most discussions about board diversity have predominantly focused on gender. However, age, tenure, racial and ethnic background and sexual orientation all are taken into consideration now. To date, studies of the racial and ethnic backgrounds of directors have been limited by a lack of consistent data since boards are not required to disclose most the demographic information requested by investors.

Company disclosures should tie to their long-term business imperatives, strategy and business activities. Actions for boards to consider to help drive progress and accountability include:

- Clearly commit to building the company’s pipeline of diverse employees and board members

- Define diversity and consider setting aggressive goals

- Hold the CEO and leadership team accountable

- Get underneath the data

- Consider using the Diverse Slates/Rooney Rule as a baseline

- Consider having job candidates provide a written statement on how they value diversity and inclusion

- Consider vendors’/consultants’ track records on diversity

- Ask management to conduct a diversity risk assessment

- Tell the company’s diversity story in detail

- Redouble employee training to combat bias

- Reassess effectiveness of the company’s voice in the public sphere

- Understand the risk of racial and other bias in the company’s data

FEI Daily: Tell me more about the economics of diversity. Why is it an important area for senior-level financial executives?

Brown: Board composition has always been critical. Companies need people from different backgrounds with a diverse set of experiences and skills in the boardroom and throughout their organizations to help drive better outcomes, and to cultivate and reinforce a culture that supports their strategy. Boards are increasingly focused on aligning board composition with the company’s strategy, today and longer term.

One reason diversity contributes to board effectiveness is that directors from different backgrounds bring perspectives to board deliberations that are influenced by their life and work experience. Therefore, board leaders should consider whether their board composition reflects the markets in which their company operates.

Diversity of people, background, and skills improve board decision-making. Boards that include more directors with diverse backgrounds and experiences are more effective on a variety of measures, including financial performance, risk oversight and sustainability.

FEI Daily: Should companies bring in outside help in addressing this?

Brown: This is a critical business issue for a company’s long-term success. And, like any other critical business issue, it is in the judgment of the board to determine if it needs third-party experts. That said, experience has shown that this is a space where many companies have tried to execute without success. This suggests the need for outside expert assistance.