In August 2019, over 180 CEOs associated with the Business Roundtable signed a new statement on the purpose of a corporation, pledging to act for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders. People from various walks of life cheered, but some CFOs and other finance leaders had concerns.

Many finance managers believe their role is to provide clear measurement of company profits and cash flow, and articulate their respective drivers to business managers. On the surface, a broader focus on driving value to various stakeholder groups seemed like a potentially large cost increase without clearly attributable benefits – bringing with it the potential risk of unfavorable financial performance comparisons.

While it’s true the benefits of stakeholder value are in many situations hard to quantify for a direct cost-benefit analysis, so too are many drivers of traditional company performance measures and shareholder value. GAAP conservatism suggests we treat marketing and R&D as current period expenses rather than investments in building a brand that consumers love or a product portfolio that delivers innovative value, yet does any CFO worth their salt not believe great brands or innovative products can be critical drivers of long-term financial performance and shareholder value? We have also seen how treating marketing and R&D as expenses (rather than investments) can result in myopic capital allocation decisions.

In parallel, there has been an increasing emphasis on corporate purpose, which seeks to explain the reason a company exists through the impact it has on its stakeholders. A company that does good things for consumers, provides fulfilling jobs and/or considers its environmental and social impact demonstrates high corporate purpose, which strengthens its bond with those stakeholder groups. By contrast, a company that places too much focus on short-term profits, even when stakeholders suffer, may lack corporate purpose in the eyes of consumers and other stakeholders.

Why should this matter to a CFO? Firstly, because corporate purpose actually can be measured quite effectively as a series of attributes that impact a company’s brand equity and reputation. And secondly, as we show below, because companies that rate highly on corporate purpose are shown to deliver improved financial performance, attract higher valuation multiples and generate much higher total shareholder returns. Thus, rather than an ill-defined expense, corporate purpose can be a measurable investment in competitive advantage. In short, with the right data and analytical approach, corporate purpose lands right on the CFO’s desk, and understanding how to articulate corporate purpose as a driver of performance will become an increasingly critical part of the finance function.

In October, we documented our findings on the relationship between purpose and performance in a report titled The Return on Purpose: Before and during a Crisis, and the study details are described below.

Return on Corporate Purpose

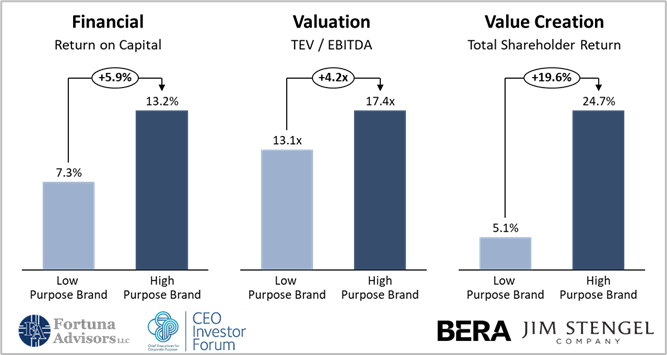

Our study used a new dataset, developed by BERA Brand Management in collaboration with the Jim Stengel Company, that measured corporate purpose as a set of thirteen different brand attributes that have a direct, causal link to value creation. These attributes, which include measures of Societal Commitment, Cultural Relevance, Point of View and Inclusivity aggregate to an overall “Purpose” score, which we used to sort companies into High Purpose and Low Purpose cohorts based on their scores relative to the sample median. We then evaluated the average performance of the High and Low cohorts on common measures of financial performance, valuation, and shareholder value creation.

High Purpose companies delivered +5% higher median returns on invested capital versus Low Purpose companies and investors assigned a 4.2x higher EBITDA multiple to High Purpose companies than Low Purpose companies. And with better returns and higher valuations, it’s no surprise that High Purpose companies deliver better long-term shareholder value creation, as evidenced by the nearly 20 percentage point advantage in annualized total shareholder returns for companies with High Purpose scores versus those with Low Purpose scores.

These findings make intuitive sense. When the corporate purpose is more closely aligned to consumer preferences, companies can spend less per dollar of revenue to acquire and serve that consumer than will a company that is misaligned with consumer preference. As a company grows, consumer acquisition costs tend to increase with the need to reach beyond early adopters. Companies must consider how to engage with and build relevance to a broader consumer group. So long as competition for those consumers remains, companies that better engage with their consumers should outperform.

We tested what these performance relationships looked like during the COVID crisis, and found that High Purpose companies outperformed Low Purpose firms by an even wider advantage during the crisis. Developing your corporate purpose in good times is an investment in building brand equity that keeps consumers loyal in challenging times.

The Business Roundtable statement may seem like a vague ideal of corporate character at first blush, and to some, a misplaced adoption of the virtues of personal character. But the world has shifted. How a corporation treats its stakeholders is no longer invisible to the end consumer, and we ask a great deal more of our consumers to remain with us in a world of increased choice. Much as a lack of personal character and integrity can erode people’s faith in someone, a lack of corporate purpose can over the long term weaken bonds with consumers and other stakeholders, and ultimately reduce a company’s ability to deliver desirable returns to shareholders.

The Finance Role in Corporate Purpose

The finance function must manage the tension between short-term results and long-term value. Where investments of any kind are made in the short term, a narrative must be communicated on how long-term value is to be created – that includes expenditures to boost corporate purpose, regardless of the accounting treatment.

There are some concrete actions a CFO can take to ensure the finance organization is fully evaluating the potential impact of corporate purpose.

Develop Your Measure: It is critical to link the cash spent on any initiative with the impact that initiative is supposed to have. We believe corporate purpose is best measured as an attribute of brand equity, which includes not just the consumer’s connection to a product, but the employee’s connection to its employer, the supplier’s connection to its partner, and the community’s connection to a company.

Set Objectives: Corporate purpose has the potential to create value across stakeholder groups, but we do not see the stakeholder value paradigm as a world free of trade-offs. Quite the opposite—it requires a clear strategic vision and resource allocation process to decide who and what to invest in and why. The finance function should engage with colleagues across the business to understand the unique needs of their respective stakeholders and the initiatives they aim to pursue in order to serve them – this includes the level of investment and how that is expected to impact your measure of performance.

Analyze Performance: Like other long-term investment, develop a clear and consistent process for analyzing performance. Be sure to develop look-backs to see if initiatives aimed at benefitting a stakeholder group actually work and are recognized as such by the stakeholder group. The approach will vary by stakeholder group and initiative, but success should be defined similarly – by its impact on long-term financial performance and value creation. Where an initiative fails to create value for stakeholders, recalibrate or reallocate toward those initiatives where you’ve measured more success.

Align Incentives: As executives develop, manage and oversee purpose, success can be improved by changing executive compensation to incorporate financial metrics that don’t penalize investments in the business as well as directly using purpose-centric metrics; in the same way that material ESG issues are featuring in elements of compensation as performance on those themes is increasingly becoming a management imperative.

Build a Purpose-Narrative: Institutional investors increasingly expect CEOs to be able to describe a clear and authentic corporate purpose. Recent surveys suggest investors expect a purpose-oriented approach to deliver strong financial performance. Given this, executives should ensure that their approach to purpose is part of their Investor Relations and year-round investor engagement and reporting efforts. This also enables executives to address a longer term time horizon and broader set of themes with the capital markets.

In summary, building on the good work of others in this space, our study suggests corporations that develop and demonstrate a clear corporate purpose are well positioned to realize a return on purpose over the long term. Finance leaders can play a critical role ensuring a measured approach to balancing short-term investment and long-term value in order to develop corporate purpose and deliver high TSR over time.

Brian Tomlinson is Director of Research of the CEO Investor Forum at Chief Executives for Corporate Purpose (CECP), Greg Milano is founder and CEO of Fortuna Advisors, Alexa Yiğit is the Head of Sustainable Finance at the CECP CEO Investor Forum and Riley Whately is Vice President at Fortuna Advisors.